Embark on a journey to explore the intricacies of comparing small business health insurance plans. This guide offers valuable insights, ensuring a thorough understanding of the process for all readers.

Delve into the nuances of each aspect to make informed decisions when choosing the right health insurance plan for your small business.

Understanding Small Business Health Insurance Plans

Small business health insurance plans are policies purchased by small businesses to provide healthcare coverage for their employees. These plans help ensure employees have access to medical services and treatments, promoting their health and well-being.

Importance of Comparing Different Plans

Comparing different small business health insurance plans is crucial to find the best coverage for your employees while managing costs effectively. By comparing plans, businesses can tailor their benefits to meet the needs of their workforce and maximize the value of their investment in employee health.

Key Factors to Consider When Comparing Plans

- Cost: Compare premiums, deductibles, and out-of-pocket expenses to determine affordability.

- Coverage: Evaluate the range of medical services and treatments covered by each plan.

- Network: Consider the network of healthcare providers included in the plan and their accessibility.

- Additional Benefits: Look for extra perks like wellness programs or telemedicine services.

- Flexibility: Assess the flexibility of the plan in terms of adding or removing coverage options.

Typical Coverage Options in Small Business Health Insurance Plans

Small business health insurance plans typically offer coverage for essential health benefits, which may include:

- Preventive care services like vaccinations and screenings.

- Hospitalization and emergency services.

- Prescription drugs and medical supplies.

- Mental health and substance abuse treatment.

- Maternity and newborn care.

Researching Available Options

When it comes to finding the right health insurance plan for your small business, it's essential to explore all available options to make an informed decision. Here are some ways to research and compare different plans:

Sources for Information on Health Insurance Plans

Before making a decision, small business owners can gather information on health insurance plans from various sources, including:

- Official websites of insurance companies

- State health insurance marketplaces

- Government websites like Healthcare.gov

- Industry publications and websites

Role of Insurance Brokers or Agents

Insurance brokers or agents can play a crucial role in helping small businesses navigate the complexities of health insurance plans. They can:

- Provide personalized advice based on your business needs

- Offer insights into different plan options and coverage levels

- Assist in comparing costs and benefits of various plans

Using Online Resources

Online resources can be a valuable tool for researching and comparing different health insurance plans. Here's how to effectively use online platforms:

- Visit insurance comparison websites to view multiple plans side by side

- Utilize online calculators to estimate costs and premiums

- Read reviews and testimonials from other small business owners

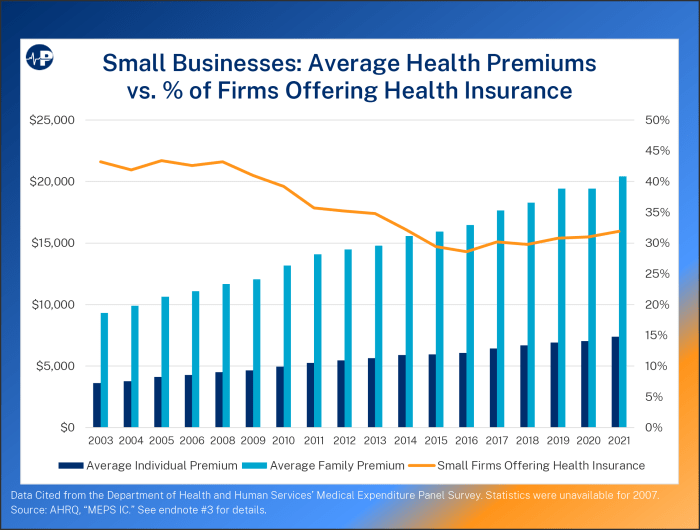

Evaluating Cost and Affordability

When comparing small business health insurance plans, it is crucial to evaluate the cost and affordability to ensure you are getting the best value for your money. Understanding the various costs associated with a plan can help you make an informed decision that aligns with your budget and coverage needs.

Premiums, Deductibles, and Copayments

- Premiums: This is the amount you pay each month to maintain your health insurance coverage. Lower premiums usually mean higher out-of-pocket costs when you receive medical services.

- Deductibles: This is the amount you must pay out of pocket before your insurance starts covering costs. Plans with lower deductibles typically have higher premiums.

- Copayments: This is a fixed amount you pay for covered medical services after you've reached your deductible. Understanding copayments can help you budget for healthcare expenses.

Tips for Balancing Cost and Coverage

- Assess your healthcare needs: Consider the health needs of your employees and choose a plan that provides adequate coverage without unnecessary expenses.

- Compare total costs: Look beyond just the premium and consider deductibles, copayments, and coinsurance to determine the overall cost of the plan.

- Utilize cost calculators: Many insurance providers offer online tools to help you estimate your total costs based on different plans and scenarios.

- Negotiate with insurers: Don't be afraid to negotiate with insurance companies to get the best rates and terms for your small business.

- Consider employee contributions: Evaluate how much you and your employees are willing to contribute towards premiums and other out-of-pocket costs.

Assessing Coverage and Benefits

When evaluating small business health insurance plans, it is crucial to assess the coverage and benefits offered to ensure that the plan meets the needs of both the business and its employees.

Types of Coverage and Benefits

- Preventive Care: Most small business health insurance plans include coverage for preventive services such as annual check-ups, vaccinations, and screenings to help employees maintain their health and detect potential issues early.

- Prescription Drugs: Coverage for prescription medications is an essential benefit that ensures employees have access to necessary medications at an affordable cost.

- Mental Health Services: With the growing awareness of mental health issues, many plans now include coverage for mental health services like therapy and counseling.

Comparing Plan Options Based on Coverage

- Consider the extent of coverage for preventive care: Compare which plans offer comprehensive coverage for preventive services without high out-of-pocket costs for employees.

- Evaluate prescription drug coverage: Look into the formulary of medications covered by each plan and assess the copayment or coinsurance required for prescriptions.

- Assess mental health benefits: Compare the coverage for mental health services, including the number of therapy sessions allowed and the copayments involved.

Prioritizing Coverage Needs

- Identify the specific healthcare needs of your employees: Consider factors like age demographics, common health conditions, and family situations to determine which coverage areas are most important.

- Balance affordability with coverage: Prioritize coverage options that meet essential needs while also being cost-effective for the business and employees.

- Seek employee input: Engage with your employees to understand their healthcare priorities and preferences, ensuring that the chosen plan meets their expectations.

Considering Provider Networks and Access to Care

When choosing a small business health insurance plan, it is crucial to consider the provider networks offered by each plan. Provider networks determine which healthcare providers, doctors, specialists, and hospitals are included in the plan's coverage.

Importance of Provider Networks

Provider networks play a significant role in ensuring access to quality healthcare services for employees. A robust network with a wide range of healthcare providers can offer employees more choices and flexibility in seeking medical care.

- Provider networks impact the cost of care: Plans with larger networks often have negotiated lower rates with providers, resulting in potential cost savings for both the employer and employees.

- Quality of care: Networks may include only accredited or highly-rated healthcare providers, ensuring that employees receive high-quality care.

- Access to specialists: Some networks may have a diverse range of specialists available, allowing employees to access specialized care when needed.

Evaluating Provider Networks

When comparing small business health insurance plans, it is essential to evaluate if a plan's network includes preferred healthcare providers that employees trust and prefer. Here are some steps to assess provider networks:

- Review the list of in-network providers: Check if employees' current healthcare providers are included in the network to ensure continuity of care.

- Consider the network size: Larger networks provide more options and flexibility for employees to choose healthcare providers.

- Check provider credentials: Ensure that providers in the network are licensed, credentialed, and meet quality standards for care.

Impact of Provider Networks on Access to Care

The type of provider network offered by a health insurance plan can significantly impact employees' access to care. For example:

A plan with a narrow network may limit employees' choices of healthcare providers and hospitals, potentially leading to longer wait times for appointments or having to travel further for care.

- Employees may face out-of-network costs if they seek care from providers not included in the network, resulting in higher out-of-pocket expenses.

- A plan with a broad network can offer employees more options for primary care, specialists, and hospitals, improving access to timely and quality healthcare services.

- Different provider networks may cater to specific healthcare needs, such as mental health services, maternity care, or chronic disease management, impacting the overall well-being of employees.

Final Summary

In conclusion, navigating the realm of small business health insurance plans requires careful consideration and informed choices. This guide equips you with the knowledge needed to make the best decisions for your business and employees.

FAQ Explained

What are the key factors to consider when comparing small business health insurance plans?

Key factors include coverage options, costs, provider networks, and access to care.

How can small business owners research available options for health insurance plans?

They can utilize online resources, consult insurance brokers, or explore information from relevant sources.

Why is it important to balance cost with coverage when comparing plans?

Balancing cost with coverage ensures that the plan is affordable while meeting the healthcare needs of employees.

What role do insurance brokers play in helping small businesses compare health insurance plans?

Insurance brokers assist in navigating the complexities of different plans, offering expertise and guidance.

How do provider networks impact access to care for employees?

The provider network determines which healthcare providers employees can visit and influences the quality of care they receive.