As Comparing Medicare Advantage and Supplemental Plans takes center stage, this opening passage beckons readers into a world crafted with good knowledge, ensuring a reading experience that is both absorbing and distinctly original.

In the realm of healthcare coverage, understanding the differences between Medicare Advantage and Supplemental Plans is crucial for making informed decisions that align with individual needs and preferences.

Introduction to Medicare Advantage and Supplemental Plans

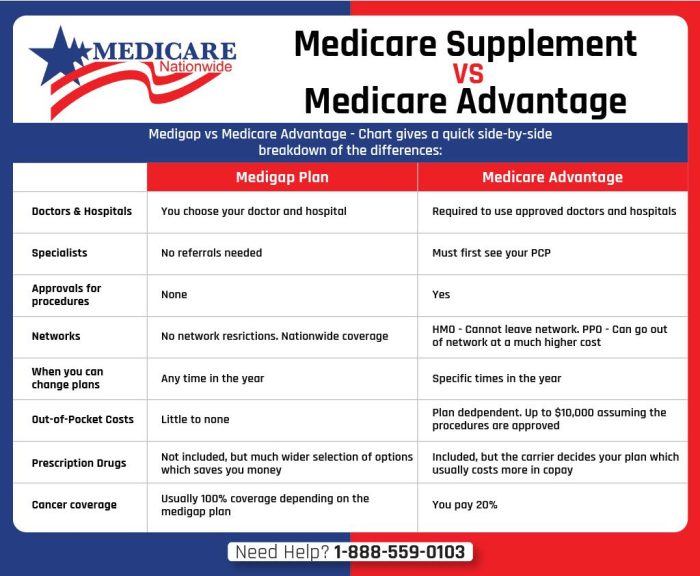

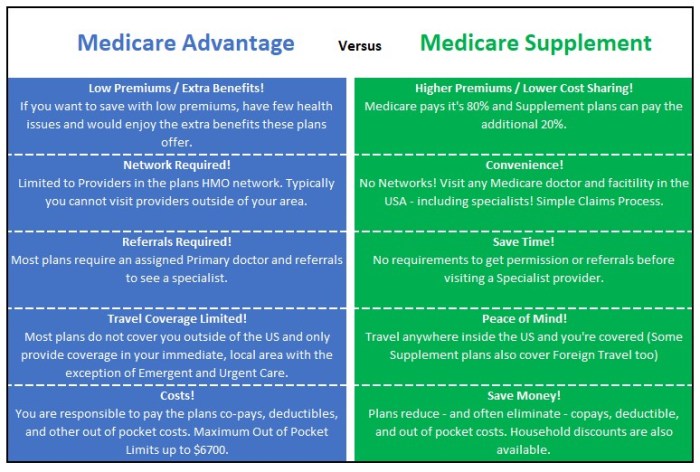

Medicare Advantage and Supplemental Plans are two types of insurance options that can provide additional coverage beyond Original Medicare. While both aim to fill the gaps in Medicare coverage, there are key differences between the two types of plans.

Medicare Advantage Plans

Medicare Advantage Plans, also known as Medicare Part C, are offered by private insurance companies approved by Medicare. These plans provide all of your Part A (hospital insurance) and Part B (medical insurance) coverage, and often include additional benefits such as vision, dental, and prescription drug coverage.

- These plans may have networks of doctors and hospitals that you must use.

- Most Medicare Advantage Plans also include a yearly limit on your out-of-pocket costs for medical services.

- Some plans may require referrals to see specialists.

Medicare Supplemental Plans

Medicare Supplemental Plans, also known as Medigap plans, are designed to help cover the costs that Original Medicare doesn't pay for, such as copayments, coinsurance, and deductibles. These plans are also offered by private insurance companies.

- Medigap plans work alongside Original Medicare, so you can see any doctor or specialist that accepts Medicare.

- These plans do not typically include additional benefits like vision, dental, or prescription drug coverage.

- Medigap plans do not have networks, so you have more flexibility in choosing healthcare providers.

Both Medicare Advantage and Supplemental Plans can be beneficial depending on your individual healthcare needs and preferences. It's essential to carefully compare the costs, coverage, and restrictions of each type of plan to determine which option is the best fit for you.

Coverage and Benefits

When comparing Medicare Advantage and Supplemental Plans, it is essential to understand the coverage and benefits each type of plan offers.

Medicare Advantage Plans Coverage

Medicare Advantage plans, also known as Medicare Part C, typically cover all the benefits of Original Medicare (Part A and Part B). In addition to hospital and medical coverage, these plans often include extra benefits such as prescription drug coverage, dental, vision, and hearing services.

Some plans may also offer fitness programs, transportation to medical appointments, and telehealth services.

Supplemental Plans Benefits

Supplemental Plans, also known as Medigap, are designed to help cover the out-of-pocket costs associated with Original Medicare, such as copayments, coinsurance, and deductibles. These plans provide additional benefits by filling in the gaps left by Medicare, giving beneficiaries more financial protection and peace of mind.

Comparison of Additional Benefits

- Medicare Advantage plans may offer additional benefits like prescription drug coverage, dental, vision, and hearing services, which are not covered by Original Medicare.

- Supplemental Plans do not typically offer these additional benefits but focus on providing financial assistance to cover out-of-pocket costs.

Cost and Affordability

When it comes to choosing between Medicare Advantage and Supplemental Plans, understanding the cost implications is crucial. Let's delve into the cost structure of both types of plans and how they can impact your overall expenses.

Medicare Advantage Plan Costs

Medicare Advantage plans typically have a monthly premium in addition to the Part B premium. These premiums can vary depending on the plan and provider. In addition to premiums, members may also have to pay deductibles and copays for services such as doctor visits, hospital stays, and prescription drugs.

Supplemental Plans and Out-of-Pocket Costs

Supplemental Plans, also known as Medigap plans, are designed to help cover the out-of-pocket costs that Original Medicare doesn't pay for, such as deductibles, copays, and coinsurance. By filling in these gaps in coverage, Supplemental Plans can help reduce the financial burden on beneficiaries.

Comparing Cost Implications

When comparing the overall cost implications of Medicare Advantage and Supplemental Plans, it's essential to consider your healthcare needs and budget. While Medicare Advantage plans may have lower premiums upfront, they often come with higher out-of-pocket costs for services. On the other hand, Supplemental Plans may have higher premiums, but they provide more comprehensive coverage and lower out-of-pocket expenses in the long run.

Network Restrictions and Flexibility

When it comes to choosing between Medicare Advantage and Supplemental Plans, one important factor to consider is the network restrictions and flexibility each type of plan offers.Medicare Advantage plans typically have network limitations in place, which means you may be required to use healthcare providers within the plan's network to receive full coverage.

Going outside of the network may result in higher out-of-pocket costs or even no coverage at all for certain services.On the other hand, Supplemental Plans, also known as Medigap plans, offer more flexibility in choosing healthcare providers. These plans work alongside Original Medicare and can help cover the costs that Original Medicare doesn't, regardless of the provider you choose to see.

This means you can see any doctor or specialist who accepts Medicare patients without worrying about network restrictions.

Impact on Accessing Care

- For Medicare Advantage plans, network restrictions can impact your ability to access care, especially if your preferred providers are not included in the plan's network. This may lead to having to switch providers or pay higher costs out of pocket.

- With Supplemental Plans, you have the freedom to see any healthcare provider that accepts Medicare, giving you more control over your healthcare choices and ensuring you can continue seeing your preferred doctors without disruption.

- Having the flexibility to choose your healthcare providers with a Supplemental Plan can be particularly beneficial if you have a longstanding relationship with a specific doctor or specialist who may not be part of a Medicare Advantage plan's network.

Enrollment and Eligibility

When it comes to enrolling in Medicare Advantage plans, there are specific eligibility criteria that individuals must meet. These plans are available to individuals who are already enrolled in Medicare Part A and Part B, also known as Original Medicare.

Additionally, most plans require individuals to live in the plan's service area.

Medicare Advantage Eligibility Criteria

- To enroll in a Medicare Advantage plan, you must be enrolled in Medicare Part A and Part B.

- You must live in the plan's service area.

- Individuals with end-stage renal disease (ESRD) may have limited options for enrolling in Medicare Advantage plans.

Supplemental Plans Eligibility and Obtaining

- Medicare Supplemental Plans, also known as Medigap, are available to individuals who are already enrolled in Medicare Part A and Part B.

- There are no specific network restrictions with Supplemental Plans, allowing individuals to see any healthcare provider that accepts Medicare.

- Supplemental Plans can be obtained through private insurance companies that are approved by Medicare to offer these plans.

Enrollment Processes

- Enrolling in a Medicare Advantage plan can typically be done during specific enrollment periods, such as the Initial Enrollment Period, Annual Enrollment Period, or Special Enrollment Periods.

- Individuals can enroll in Supplemental Plans at any time, but it's recommended to do so during the Medigap Open Enrollment Period, which starts when you are 65 or older and enrolled in Medicare Part B.

- Both types of plans require individuals to be enrolled in Medicare Part A and Part B to be eligible for enrollment.

Considerations for Chronic Conditions

Chronic conditions are a significant factor to consider when choosing between Medicare Advantage and Supplemental Plans. Let's analyze how each type of plan caters to individuals with ongoing health needs.

Medicare Advantage Plans

Medicare Advantage plans often provide comprehensive coverage for individuals with chronic conditions. These plans typically include benefits such as disease management programs, prescription drug coverage, and preventive care services. Moreover, some Medicare Advantage plans may offer additional services like telehealth visits and care coordination to help manage chronic illnesses effectively.

Supplemental Plans

Supplemental Plans, also known as Medigap plans, are designed to fill the gaps in Original Medicare coverage. While Supplemental Plans do not typically cover chronic conditions directly, they can help offset out-of-pocket costs associated with ongoing health needs. For example, Supplemental Plans can cover copayments, coinsurance, and deductibles, making it more affordable for individuals with chronic conditions to access necessary medical care.

Coverage Options for Managing Chronic Illnesses

Under Medicare Advantage plans, individuals with chronic conditions can benefit from specialized care management programs, prescription drug coverage, and preventive services. These plans often emphasize coordinated care and proactive health management to improve health outcomes for individuals with ongoing health needs.On the other hand, Supplemental Plans focus on financial assistance by covering out-of-pocket costs related to chronic conditions.

While Supplemental Plans do not provide direct medical care, they can significantly reduce the financial burden of managing chronic illnesses, ensuring individuals have access to necessary treatments and services without breaking the bank.Overall, when considering chronic conditions, individuals need to weigh the comprehensive coverage and care management options offered by Medicare Advantage plans against the financial assistance and cost-sharing benefits provided by Supplemental Plans.

Outcome Summary

In conclusion, the comparison between Medicare Advantage and Supplemental Plans sheds light on the nuances of healthcare coverage, offering a comprehensive view of the options available and empowering individuals to navigate the complex landscape of Medicare with confidence.

FAQ

What are the key differences between Medicare Advantage and Supplemental Plans?

Medicare Advantage plans are comprehensive and often include prescription drug coverage, while Supplemental Plans fill in the gaps left by Original Medicare, such as copayments and deductibles.

How do Supplemental Plans help with out-of-pocket costs?

Supplemental Plans, also known as Medigap plans, cover costs that Original Medicare doesn't, such as copayments, coinsurance, and deductibles.

Who is eligible for Supplemental Plans and how can they be obtained?

To be eligible for a Supplemental Plan, you must be enrolled in Medicare Part A and Part B. These plans are purchased from private insurance companies.

How do Medicare Advantage plans cater to individuals with chronic conditions?

Medicare Advantage plans often offer additional benefits tailored to managing chronic conditions, such as disease management programs and telehealth services.